Inside China’s Consumer LBO Boom – A Battlefield for Private Equity Funds

Shanghai skyline. Source: Pexels

Starbucks agreed to sell a 60% majority stake in its China business to the private equity group Boyu Capital in November. They built a joint venture (JV) at a US$4 billion valuation and aim to more than double the number of cafés in China. Meanwhile, CPE Yuanfeng, backed by CITIC (China International Trust Investment Corporation, one of the largest financial institutions in China), has acquired 83% of Burger King’s China business for US$350 million, aiming to more than triple its number of stores from 1,250 to 4,000 in China over the next 10 years.

These transactions reflect renewed confidence in China’s consumer LBO market, despite a challenging macroeconomic environment that still exists. According to Bain & Company’s 2025 report, in 2024 the total PE deal value in Greater China rose 7% to US$47 billion, driven in large part by large buyout (LBO) deals. Global brands are increasingly willing to partner with domestic PE funds to accelerate their expansion, while Chinese funds are stepping in as consolidators with long-term capital and operational improvement capabilities. Valuations already imply optimism around scale-driven growth and operational upsides, rather than short-term consumption recovery alone.

Strategic Rationale

Post-investment management is extremely important for private equity LBO transactions, as operational and margin improvements can drive up exit multiples and therefore increase returns for private equity funds. These global consumer giants seek to cooperate with PE funds by utilizing their expertise in retail store management, marketing and branding, supply chain management, and product upgrades that fit the local Chinese market. Brian Niccol,Chief Executive Officer of Starbucks, stated: “Boyu’s deep local knowledge and expertise will help accelerate our growth in China.”

Exterior of Starbucks Coffee Shop. Source: Pexels

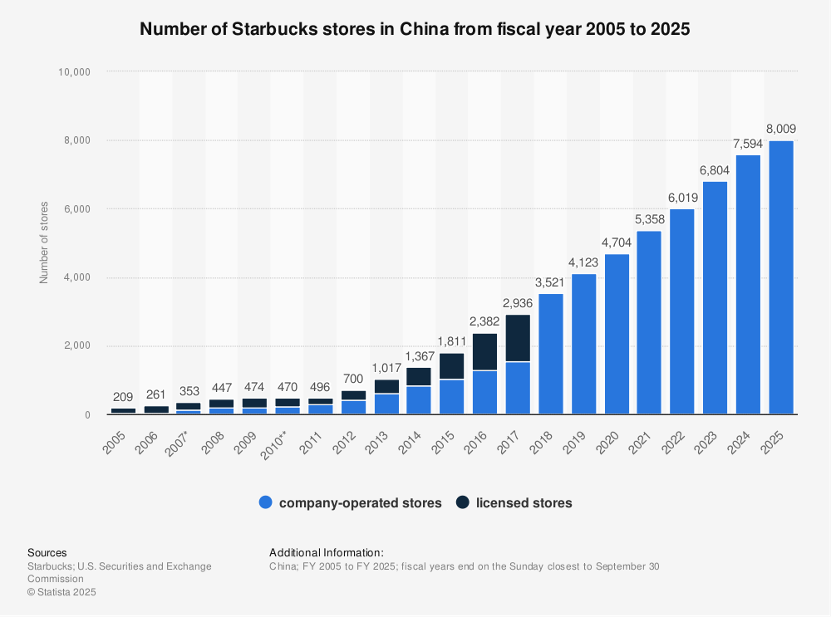

Starbucks Case Study – Competition in China

Starbucks is facing increased competition from China’s local coffee brands, including Luckin Coffee. Although Luckin Coffee encountered an accounting fraud involving the fabrication of over US$300 million in sales in 2020, which led to its delisting from the Nasdaq Stock Exchange, the company has recovered in recent years. By 2022, the PE fund Centurium Capital obtained around 57% of the voting rights in Luckin Coffee by continuously acquiring shares from existing shareholders, and the PE group led operational improvements in store expansion and online marketing. By the end of the fiscal year 2024, the total number of Luckin Coffee stores reached 22,340, including 14,591 self-operated stores and 7,749 partner / affiliated stores. Meanwhile, Starbucks has more than 40,000 coffee stores globally but only around 8,000 stores in China.

Luckin Coffee’s main competitive advantages focus on pricing and localization. The average price of a cup of Luckin Coffee is around US$1.75 – US$2.40, while the price of a cup of Starbucks coffee in China is around US$4.00, portraying Starbucks’ disadvantage when it comes to prices. Luckin Coffee also offers a promotion in which customers can buy their first coffee each week for less than US$1.50. Moreover, Luckin provides many localized coffee products, among which the most famous is the “Fresh Coconut Latte,” which is highly attractive to Chinese consumers. Previously, the upper middle class in China viewed Starbucks as a symbol of social status due to the brand’s reputation and relatively high prices, but the broader consumer base in the coffee market now focuses more on price and taste compatibility. Therefore, Starbucks’ future improvement strategy should emphasize store expansion, price adjustments, and product upgrades and localization in China.

Source: Statista

Implications for PE Funds

The founder of Boyu Capital (acquirer of Starbucks China) is Alvin (Zhicheng) Jiang, the grandson of former Chinese President Zemin Jiang. After graduating from Harvard University, he worked at Goldman Sachs Asia and founded Boyu Capital in 2010, based in Hong Kong. Boyu Capital’s portfolio spans technology, real estate, consumer and retail, and fintech companies, including investments in Alibaba, RedNote, and a 45% equity stake in Beijing SKP (one of the most iconic luxury shopping malls in China). The firm recently planned to raise around RMB 10 billion for its new fund.

The founder of Centurium Capital (acquirer of Luckin Coffee) is David (Hui) Li, the son of one of the founding generals of the People’s Republic of China, Yuan Li. He graduated from Yale University and Stanford University and worked at Warburg Pincus for 14 years. He founded Centurium Capital in 2017. Prior to Warburg Pincus, he worked in the Investment Banking Divisions of Goldman Sachs and Morgan Stanley. CPE Yuanfeng Capital (acquirer of Burger King China) was formerly the CITIC Industry Fund, and CITIC is one of China’s largest state-owned financial institutions.

The background of these PE funds participating in major LBO transactions suggests another implication: the key players in China’s consumer and retail investment space combine deep financial expertise with strong state-linked backgrounds. This demonstrates the interest of state-related Chinese funds in acquiring profitable and reputable global consumer brands’ China operations. These consumer giants are also willing to collaborate with PE funds with state ties to form JVs that can better support localization and strengthen competition with domestic brands.

Moreover, Western PE funds are also participating in China’s consumer and retail market by acquiring both international and local profitable brands. For example, KKR’s acquisition of Dayao (one of the most prominent regional beverage businesses in China) demonstrates global PE interest in scaling strong domestic consumer brands using capital and operational expertise to transform leading regional products into national platforms. Meanwhile, Carlyle’s acquisition of control over McDonald’s China in 2017 aimed to localize operations, accelerate store expansion, and improve efficiency through post-investment management, reflecting confidence in China’s long-term consumption growth despite short-term volatility.

Risks in China’s Consumer & Retail LBO Market

Carlyle’s acquisition of McDonald’s China and its successful exit in 2023, which generated approximately a 6.7x return, provides a valuable reference case for Boyu Capital and CPE Yuanfeng Capital in operating their portfolio companies in the future. However, future risks mainly lie in exit opportunities, as PE exits have declined in recent years and China’s consumer market remains volatile. Due to S&P Global, total PE exit value globally fell to a five-year low of US$392.5 billion in 2024.

Conclusion

China’s consumer LBO market is booming as the global brands partner with domestic private equity funds to drive localized growth. Deals such as Boyu Capital’s acquisition on Starbucks and CPE Yuanfeng’s acquisition on Burger King all highlighted the confidence in scale expansion and operational improvement despite the macro uncertainty. PE funds bring retail, supply chain, and branding expertise, often backed by state-linked capital. Intense competition from local brands like Luckin Coffee is also pushing for pricing and localization. However, exit uncertainty and market volatility remain as the key risks.